franklin county ohio sales tax rate 2020

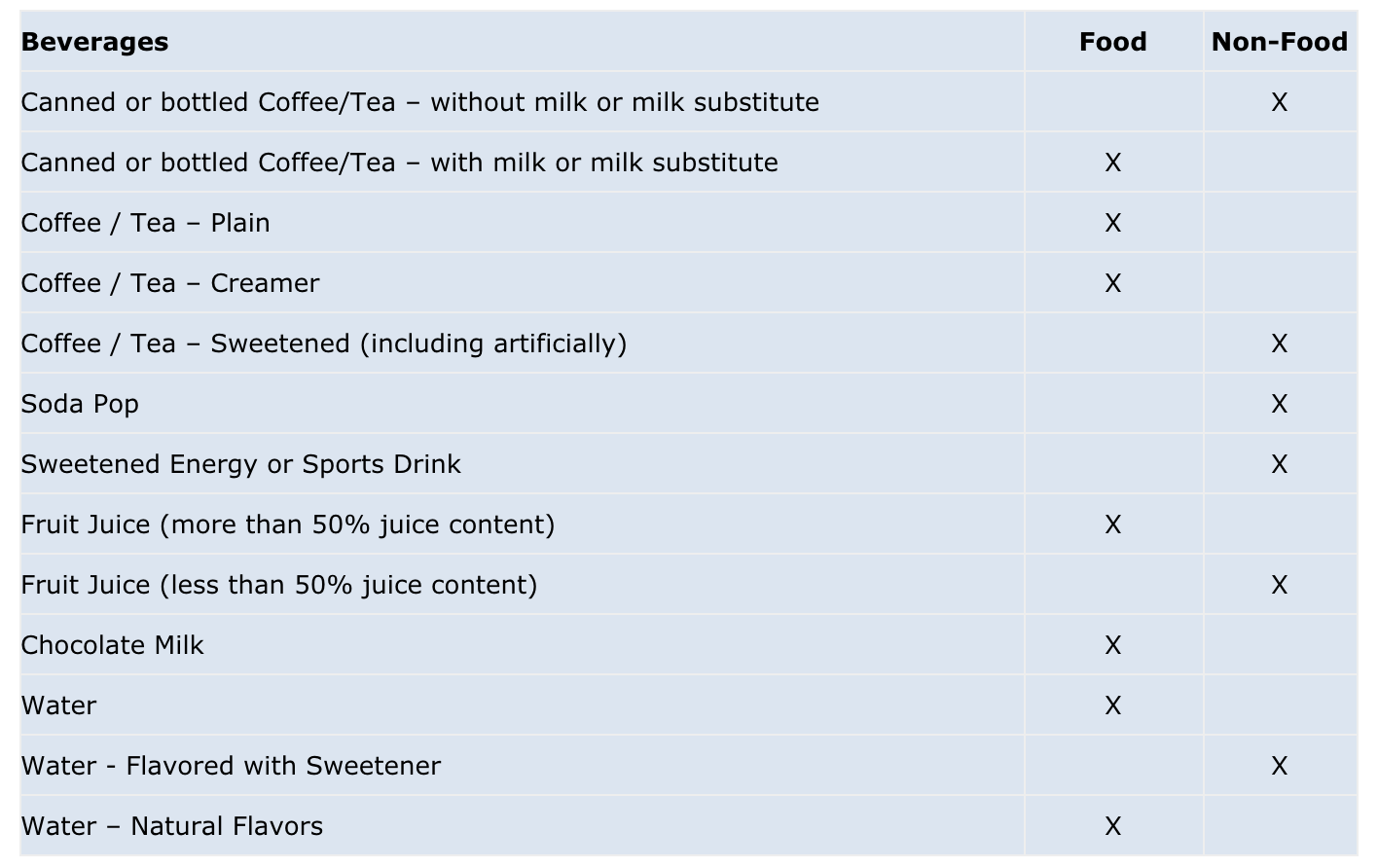

An alternative sales tax rate of 75 applies in the tax region Carlisle which appertains to zip code 45005. Cultural Services Community Enrichment.

.png)

Job Opportunities Sorted By Posting Date Descending Franklin County Engineer Job Opportunities

2022 TAX LIEN SALE The Franklin County Treasurers Office will conduct its annual Tax Lien Sale on October 31 2022.

. Big Prairie 44611 Holmes 700. Our office is open Monday through Friday 800 am. Blackfork 45615 Lawrence 725.

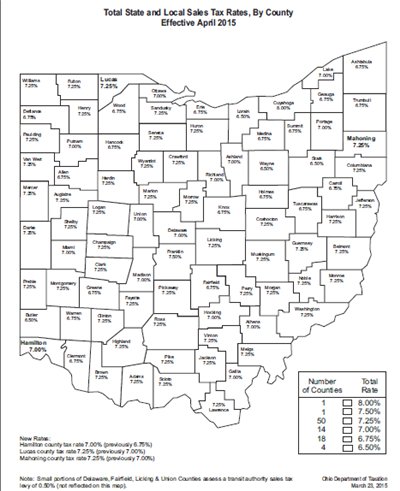

Map of current sales tax rates. There were no sales and use tax county rate changes effective October 1 2022. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

This is the total of state and county sales tax rates. The current total local sales tax rate in Franklin OH is 7000. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

- The Finder This online tool can help determine the sales tax. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. 614-221-8124 HOURS OF OPERATION.

Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725. Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to. Tax Rate Share.

Missouri has a 4225 sales. 2022 TAX LIEN SALE The Franklin County Treasurers Office will conduct its annual Tax Lien Sale on October 31 2022. The Franklin Ohio sales tax rate of 7 applies in the zip code 45005.

Bidwell 45614 Gallia 725. The December 2020 total local sales tax rate was also 7000. High st 17th floor columbus oh 43215-6306 PHONE.

Bexley 43209 Franklin 750. The December 2020 total local sales tax rate was also 7250. The Ohio state sales tax rate is currently.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. Birmingham 44816 Erie 675.

The parcels in the link below are considered. Our office is open Monday through Friday 800 am. High st 17th floor columbus oh 43215-6306 PHONE.

The Columbus Convention and Visitors Bureau Promoting the City 168 3294. The base state sales tax rate in Ohio is 575. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

The current total local sales tax rate in Franklin Furnace OH is 7250. The sales tax jurisdiction. The current total local sales tax rate in Franklin County OH is 7500.

614-221-8124 HOURS OF OPERATION. Ohio has a 575 sales tax and Franklin County collects an additional. The December 2020 total local sales tax rate was also 7500.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125. There is no applicable city tax. What is the sales tax in Ohio 2021.

The parcels in the link below are considered delinquent in. In transactions where sales. Some cities and local.

The sales tax jurisdiction. Blacklick 43004 Franklin 750.

Ohio Taxes Apps On Google Play

Ohio Taxes Apps On Google Play

Ohio Income Tax Calculator Smartasset

Sales Tax Tuesday Ohio Insightfulaccountant Com

State And Local Sales Tax Rates In 2015 Tax Foundation

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ohio Tax Rates Rankings Ohio State Taxes Tax Foundation

Louisiana Sales Tax Rates By County

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

How Nc S New Tax Cuts Will Save Taxpayers Billions

Franklin County Unlikely To Raise Taxes Despite Covid Revenue Drop

Ohio Cities Try To Calculate Income Tax Hit From Those Working At Home

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Workers File For Local Municipal Income Tax Refunds On Returns

Property Tax Abatements How Do They Work

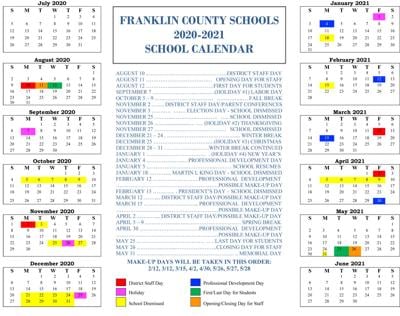

Franklin County Schools Approve 2020 21 Calendar Education State Journal Com

The Ultimate Guide To North Carolina Property Taxes

Franklin County Property Tax Bills Late Deadline Extended To Jan 31